Understanding Your Health Care Cost

How Billing Works

The hospital / clinic adds up the charges for all the services you received during a specific hospital stay, emergency department visit or clinic visit over a specified period of time and sends this electronically to your insurance company. This is called a “claim.”

Your insurance company reviews:

- What your policy lists as your yearly deductible amount

- What your policy lists as your coinsurance percentage

- What your out of pocket maximum is

- How much you have already paid this year in health care costs

Your insurance company then determines how much of the bill you will pay and how much they will pay. If you have not yet spent your out of pocket maximum amount:

- You pay your deductible amount remaining for the year

- If this doesn’t pay for all of the charges, you also pay your coinsurance amount

The insurance company sends you an “Explanation of Benefits” statement, which tells you what you can expect to owe when you receive the bill from the hospital/clinic. If you have reached your deductible amount, the insurance company sends a payment to the hospital/clinic for the amount they owe and tells them the amount you owe. The hospital/clinic sends you a bill for this amount.

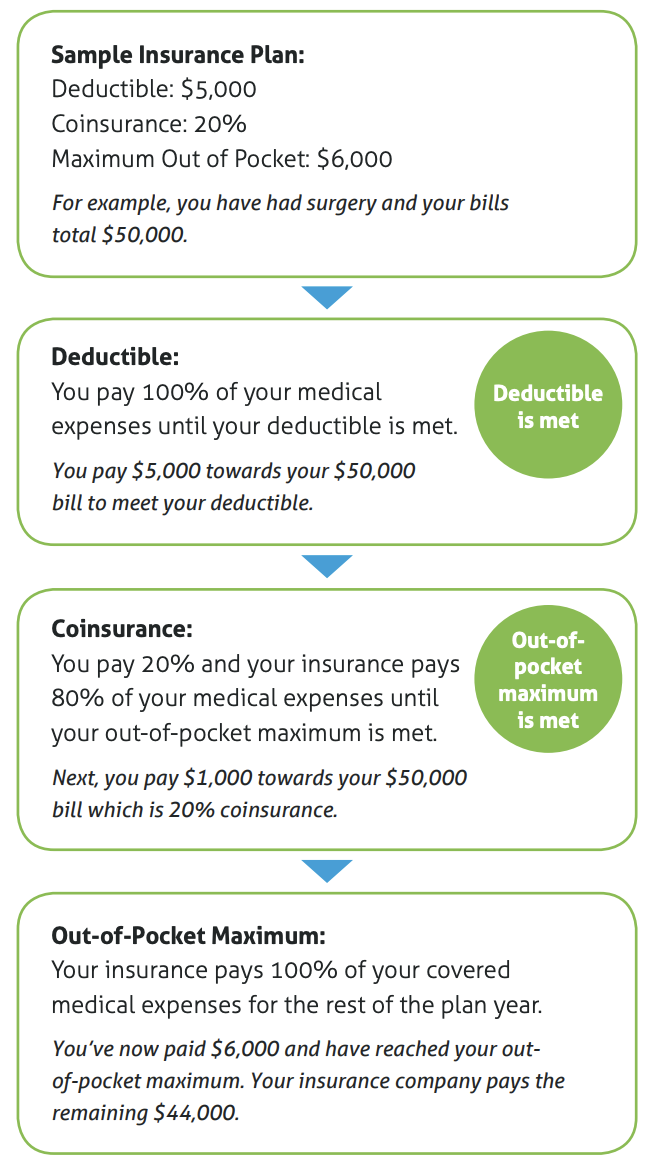

Example of How an Annual Health Insurance Plan Might Work

Note: You may also receive a bill from other physicians/ Care Costs medical providers who provide services to patients at Northfield Hospital. These may include a pathologist, radiologist, anesthesiologist, surgeon or other specialty physician such as a cardiologist. These providers bill for their services separately through their own billing offices.

Insurance Overview

Insurance companies share the cost of healthcare with you, but only after you first spend a specified amount each year. The dollar amount you will spend for healthcare begins with the medical insurance policy you agree to.

It’s important to know what healthcare services and providers your policy does and does NOT cover because you will have to pay for all non-covered services and all out of network providers out of your own pocket. It’s also important that you know what your policy says about how much you agree to pay every year out of pocket for your care. This will allow you to set this money aside when you need it.

What is a Deductible?

A deductible is a specific amount of money you have agreed to pay for your medical expenses before your health insurance plan begins to pay for covered medical expenses. Insurance companies typically offer deductible options in the range of $1,000 to $10,000. For example, if you have chosen a $5,000 deductible, you will need to pay the first $5,000 of your medical expenses before your insurance will start helping you to pay the remaining costs.

What is Coinsurance?

Coinsurance is the shared cost between you and your insurance company once you’ve paid your deductible. Over a plan year, your insurance company keeps track of how much you pay toward hospital and clinic bills. Once you’ve paid enough to reach your deductible amount, your insurance company will help by paying for a certain percentage of the costs. For example, once your deductible is met, you may pay 20% and your insurance company may pay 80% of the charges.

What is an Out-of-Pocket Maximum?

An out of pocket maximum is the most money you will have to pay for covered medical expenses in a year. Once your deductible and coinsurance payments reach this amount, your insurance company pays 100% of the remaining charges for covered services. For example, if your out of pocket maximum is $6,000 and you’ve paid $6,000 worth of medical expenses, the insurance company will pay 100% of all remaining covered charges.

Other Resources

Our Patient Financial Services staff are happy to help you with questions. You may contact them at 507-646-1399 during normal business hours.